Chase UK

Chase makes investing more rewarding with Nutmeg link

3 mins | 07 February 2023

- Customers of Chase and Nutmeg can link their investment accounts in the Chase app

- Chase customers that start investing with Nutmeg via the Chase app can benefit from £100 investment boost

- Start of Nutmeg products and services becoming fully integrated with Chase

London, February 7, 2023 - Chase announces first significant step in integration of Nutmeg investments, with account linking and investment sign-up available in the Chase app.

Chase announces first significant step in integration of Nutmeg investments, with account linking and investment sign-up available in the Chase app.

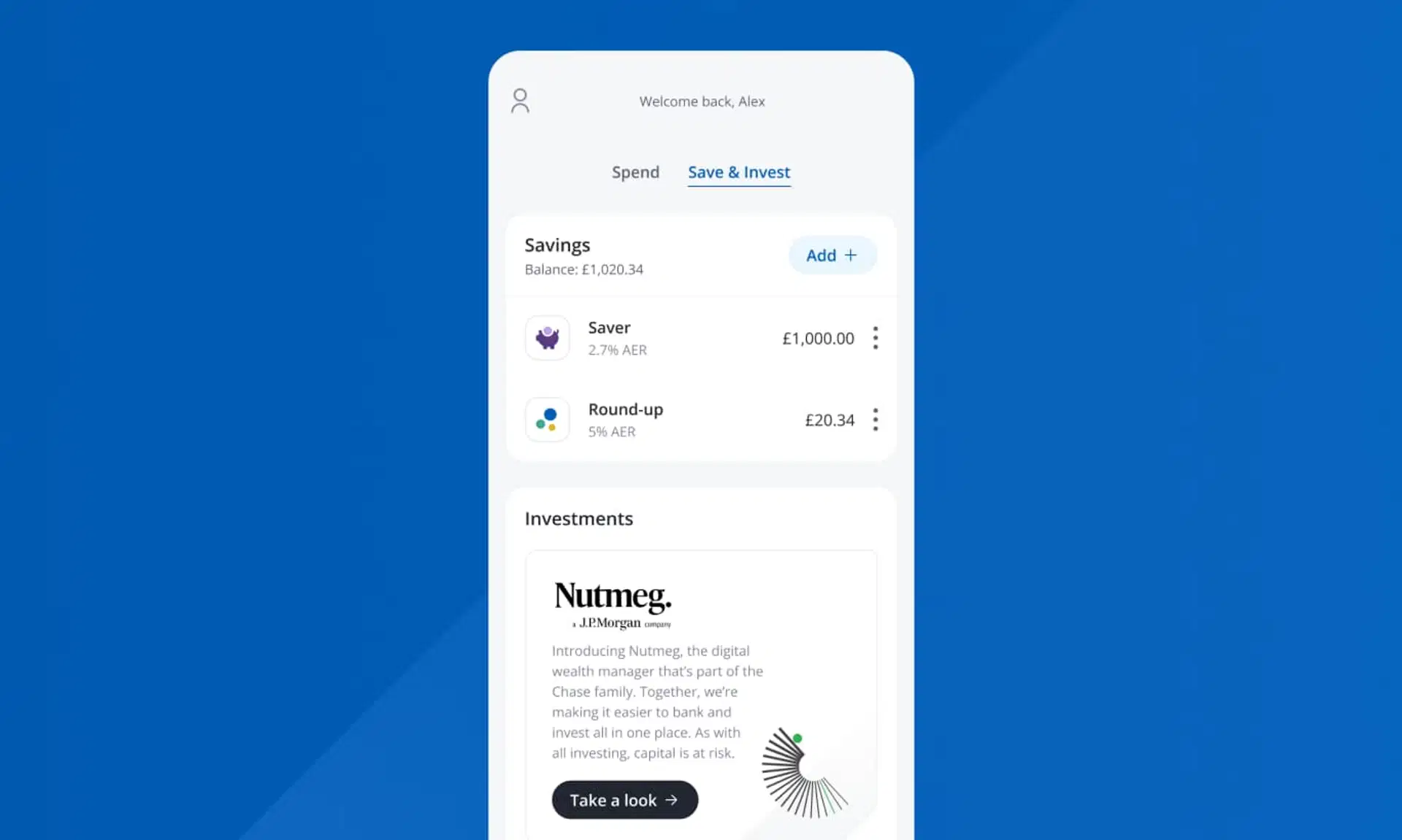

Over the coming weeks, customers of both Chase and Nutmeg will be able to link their accounts and view their Nutmeg investment pots alongside their current account and Chase saver accounts within the Chase app. The development will provide customers with a holistic view of their everyday banking, cash savings and stocks and shares ISAs, Lifetime ISAs, Junior ISAs, pensions and general investment accounts.

Chase customers who are not yet investing with Nutmeg will have the opportunity to benefit from a £100 investment boost when they sign-up through their Chase app and invest £1,000 with Nutmeg before 5th April 2023 and remain invested until 30th June 2023, terms and conditions apply. Customers need to:

- Log in to the Chase app and go to the 'Save & Invest' tab, then scroll down to 'Investments' and tap 'Take a look'

- Choose 'I'm new to Nutmeg' and follow the on-screen steps to 'Get started'

- Confirm or edit their details, before reading and accepting the T&Cs

- When prompted, install or open the Nutmeg app, create and contribute at least £1,000 to an account.

Bringing Chase and Nutmeg together in one place gives customers greater control, transparency and oversight of their finances, while also providing Chase's one million banking customers with easy access to award-winning investment products and financial planning services.

Sanjiv Somani, U.K. CEO of Chase and Nutmeg, commented: "We set out to offer customers a more rewarding banking experience, with good value products and services that meet their needs. We know investing is of interest to many Chase customers and Nutmeg has spent a decade democratising wealth management and making investing more accessible to more people. Providing our customers with a single view of their wealth - be it their everyday spending, cash savings or their long-term investments - helps them to better understand their own financial position at a time when it has arguably never been more critical."

In 2021, JP Morgan Chase announced its acquisition of the UK's largest digital wealth manager, Nutmeg, to complement digital bank Chase, and to form a key pillar of its retail banking and wealth management offering outside the U.S. Over time, Chase intends to introduce a broad range of products for U.K. customers that meet their financial needs. This will include fully integrating Nutmeg investments within the Chase app, and adding features and enhancements to the Chase current account, new savings options for customers, and lending products such as a Chase credit card.

Notes to editors

£100 investment boost: Chase customers that don't have a Nutmeg account can get a £100 investment boost by opening an investment account through the Chase app. Pay in at least £1,000 to a Nutmeg ISA, Lifetime ISA, Junior ISA, general investment account or pension before 5th and remain invested until 30 June 2023 and Nutmeg will add £100 to the customer's Nutmeg account. Terms and conditions apply and are available here:

Award-winning: In 2022, Nutmeg was awarded Boring Money Best Buy ISA, Best Buy Pension, Best Buy LISA, Best Buy JISA, Best for Sustainable Investing, Best for Beginners, and Best for Customer Service.

UK's largest digital wealth manager: Boring Money Online Investing Report 2022. Nutmeg largest digital wealth manager by AUM. Digital wealth managers recommend and manage portfolios based on customer attitude to risk.

Interest in investing: 54% of customers polled on personal finance topics they would be most interested in knowing more about said ‘Investing your money’. Poll carried out by Maru on behalf of Chase U.K. and completed online in November 2022.

About Chase in the U.K.

Chase is the consumer and commercial banking business of JPMorgan Chase & Co (NYSE: JPM), a leading global financial services firm with assets of $3.7 trillion and operations worldwide.

The U.K. bank is designed specifically to meet the needs of customers in the country, providing a range of banking products and features. In the UK, Chase is a trading name of J.P. Morgan Europe Limited. J.P. Morgan Europe Limited is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. For more information, go to www.chase.co.uk.

About Nutmeg

Nutmeg is the UK’s largest digital wealth manager, offering clarity and transparency to both seasoned and first-time investors as they seek to achieve their financial goals. Launched in September 2012, Nutmeg now manages over £4.5bn on behalf of over 200,000 clients who have sought the powerful combination of an easy-to-use, adaptable investment service and award-winning client services, and financial guidance, planning and advice. Nutmeg is a J.P. Morgan company offering investments and digital wealth management services to consumers, complementing Chase’s digital bank in the UK. For more information, please see www.nutmeg.com

All information correct at time of publication

Risk warning

As with all investing your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Tax treatment depends on your individual circumstances and may be subject to change in the future.